portability estate tax return

This should only be addressed to ensure that state estate tax returns are filed if applicable. Accordingly the due date of an estate tax return required to elect portability is nine months after the decedents date of death or the last day of the period covered by an extension if an extension of time for filing has been obtained.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

With the introduction of portability now all a surviving spouse has to do to preserve the DSUEA is file an estate tax return within nine months or two years in certain situations from their spouses date of death.

. I always like to review the Form 706 with the estate attorney to make sure that nothing is missed. The effect is that wills and revocable trusts for most married couples have become much more simplified in recent years. Even if the size of the estate is below the threshold for filing Form 706 filing Form 706 is the only way to make this election.

Portability enacted as part of the American Taxpayer Relief Act in 2013 allows a surviving spouse to use a deceased spouses unused exemption. These steps could be easily overlooked since an Estate Tax Return does not necessarily have to be filed if the estate is below the exemption amount. Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return.

In order to have use of a deceased spouses unused. This could have been totally avoidable if Jane had acted upon portability in. When enacted it was meant to apply only to estates of decedents dying before January 1 2013.

Estate tax return preparers who prepare a return or claim for refund which reflects. Form 706 To use the DSUE the estate must timely file an Estate Tax Return when the first spouse passes away and the portability election must also be properly completed. When filing the taxes its important to select the portability election to have the benefits transferred to the surviving spouse.

Consider state portability options. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. The Tax Relief Unemployment Insurance Reauthorization and Job Creations Act of 2010 introduced for the first time the concept of portability of the federal estate tax exclusion between spouses.

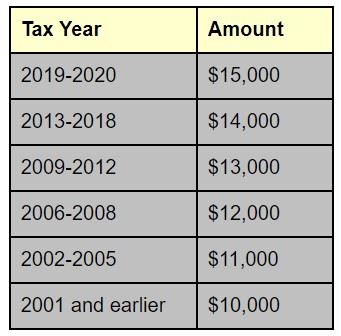

For all deaths after 2010 the IRS grants an automatic extension provided. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the. November 11 2021 Portability is the term used to describe a new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life and estate tax at the surviving spouses death.

Citizen or resident The executor wasnt otherwise required to file an estate tax return and didnt file one by the deadline. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make. The deceased was a US.

The estate must file a federal return to elect portability but any QTIP election made therein will be treated as null and void. To claim estate tax portability the estate tax representative must file an estate tax return within 9 months of the first spouses death. Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life andor estate tax at the surviving spouses death.

The IRS acknowledged this issue and. What Does Portability of the Estate Tax Exemption Mean. This is a bizarre result leaving practitioners and clients troubled and skeptical.

Most states do not have an estate tax and only a couple allow for portability. 2 days agoAt the current 40 tax rate Jimmy is stuck owing 2 million in estate tax. See 206075-1 and 206081-1 for additional rules relating to the time for filing estate tax returns.

An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely. Portability must be elected on a timely filed estate tax return Form 706 for the first spouse who dies.

The sole purpose of this 706-EZ would be for taxpayers to fulfill their responsibility of filing an estate tax return to elect portability and to detail the calculation of the deceased spousal. If the estate needs more time to file for portability they can apply for a 6-month extension. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process.

Review Form 706 with estate attorney. In 2017 the IRS made it easier for estates to obtain an extension of time to file a portability election. Importantly under New York law a separate QTIP election is not available.

A Trust May Be Taxed As Either A Grantor Trust Or A Nongrantor Trust Each Type Of Trust Has Advantages And Disadvanta Estate Tax Estate Planning Grantor Trust

This Is Another In A Series Of Blogs On The Basics Of Estate Planning Estate Planning Attorneys Do Estate Planning Estate Planning Attorney Law Firm Marketing

A New Era In Death And Estate Taxes

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Estate Tax Introduction Video Taxes Khan Academy

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Cactus Flora Plant Light Bulbs Hanging Light Bulbs Hanging On Top Of Cactus Halloween Home Decor Professional Decor Amazon Home Decor

Tips For Filing Taxes When Married Rings Married Married Couple

Federal Estate Tax Portability The Pollock Firm Llc

Don T Forget About Making A Portability Election Capell Howard P C

The New Estate Tax Exemption And Portability Panacea Or Poison

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Exploring The Estate Tax Part 2 Journal Of Accountancy

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax