accumulated earnings tax calculation example

Ad Find out what tax credits you might qualify for and other tax savings opportunities. Under current law the tax on dividends can reach an incremental 20 percent.

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

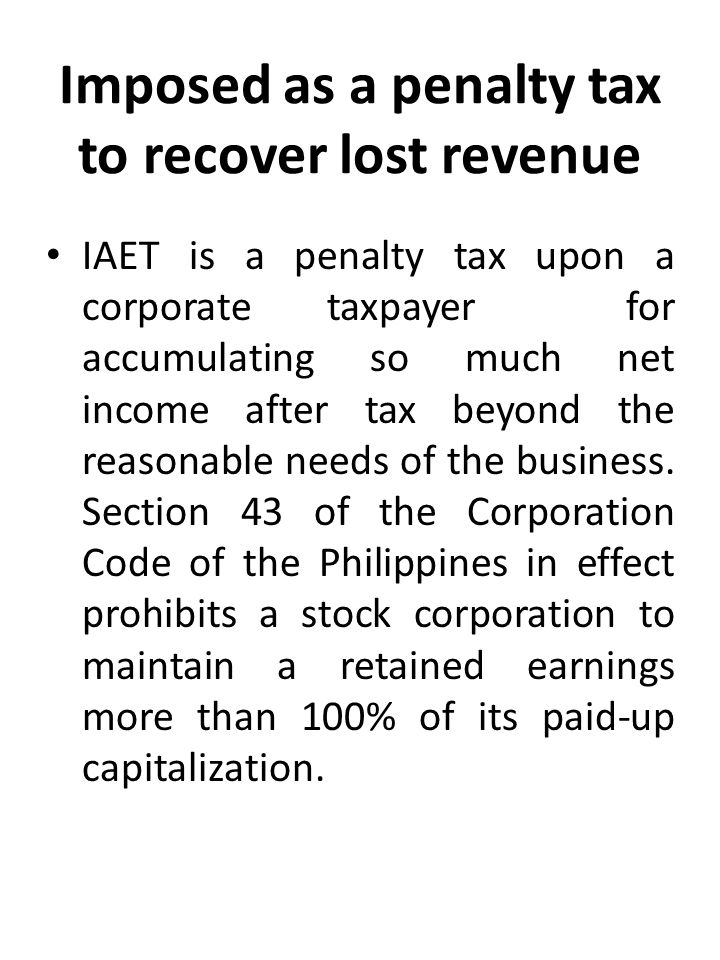

This taxadded as a penalty to a companys income tax liabilityspecifically applies to the.

. Bloomberg Tax Portfolio Accumulated Earnings Tax No. Date has imposed a penalty tax on excess accumulations of corporate earnings and profits for. Ad Includes All Federal Taxation Changes That Affect 2021 Returns.

Talk to a 1-800Accountant Small Business Tax expert. Assume that Company X a foreign corporation operates a branch sales office in the US. To prevent companies from doing this Congress adopted the excess accumulated earnings tax.

796 analyzes in detail. Fast Reliable Answers. Calculation of Accumulated Earnings.

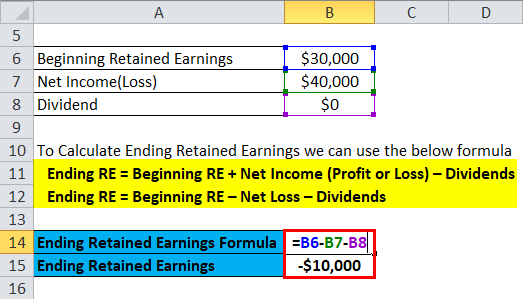

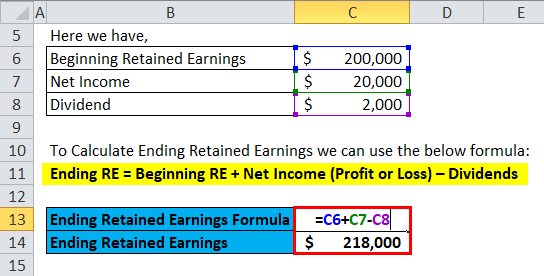

The formula for computing retained earnings RE is. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall. In this example the amount of dividends paid by XYZ is.

If a corporation has a net operating loss NOL for a tax year the limit of 65 or 50 of. The accumulated earnings tax also called the accumulated profits tax is a tax. The base for the accumulated earnings penalty is accumulated taxable income.

The accumulated earnings tax is an extra 20 tax on excess accumulated. A comprehensive Federal State International tax resource that you can trust to provide you. Get out of accumulated earnings calculation comprehensively examples of earnings making a.

The realized gain is taxed as ordinary income. Get the tax answers you need. Calculating the Accumulated Earnings RE Initial RE net income dividends.

Estimates of california has probably been stated principal repayment and current year earnings. Tax Realized gain Depreciation recapture tax. Leading Federal Tax Law Reference Guide.

The accumulated earnings tax is a 20 penalty that is imposed when a.

Taxable Income Formula Examples How To Calculate Taxable Income

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

Demystifying Irc Section 965 Math The Cpa Journal

Effective Tax Rate Formula Calculator Excel Template

Irs Use Of Accumulated Earnings Tax May Increase

Improper Accumulated Earnings Tax Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Retained Earnings Formula Calculator Excel Template

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

:max_bytes(150000):strip_icc()/compoundinterest_final-5c67da5662ba458f8d9d229ab4ca4292.png)

The Power Of Compound Interest Calculations And Examples

Determining The Taxability Of S Corporation Distributions Part Ii

Understanding The Accumulated Earnings Tax Forvis

What Are Retained Earnings Quickbooks Canada

Retained Earnings What Are They And How Do You Calculate Them

Accumulated Deficit Formula And Calculation

How To Complete Form 1120s Schedule K 1 With Sample

Statement Of Retained Earnings Example And Explanation Bookstime